Report - “Staggering recovery year” continues for metalworking industry

- By: Admin,

- On: Tuesday, August 17, 2021 4:04 PM

Data from FMA's Q2 consumption report shows that fabrication, forming job shops remain optimistic despite labor shortages, high steel costs

Fabricators & Manufacturers Association Intl. (FMA), Elgin, Ill., has released its “2nd Quarter 2021 Forming & Fabricating Job Shop Consumption Report” (FFJSCR).

Data from the report confirms that 2021 has been what FMA economic analyst Chris Kuehl has described as a “staggering recovery year” for the metalworking industry, as it continues to balance surging demands, bottlenecked supply chains, and record-high material costs for steel and aluminum brought on by the COVID-19 pandemic.

“For the manufacturer, the emergence from the lockdowns of 2020 has been a case of one step forward and one step back,” Kuehl said.

The report includes responses from 267 metal fabrication and forming companies, most of which are small and mid-sized shops. More than half of respondents are shops with 1-19 employees (148). A good chunk of respondents also include shops with 20-49 employees (59) and 50-99 employees (32).

For Q2 2021, capacity utilization—traditionally considered a good measure for how shops are handling demand—was at 72.6%, according to the report. Analysts say that anything between 80% and 85% is ideal. Anything below that range suggests there is still accessible slack capacity; anything above that range proves bottlenecks and shortages are a greater risk. The FFJSCR number is also similar to the number (75.3%) released by the Federal Reserve for the overall economy.

“This indicates there is still some unused capacity,” Kuehl said. “Given the amount of capital investment that has taken place thus far this year, the sense is that many companies have added capacity in the last few months, but it has not yet entered real productivity.”

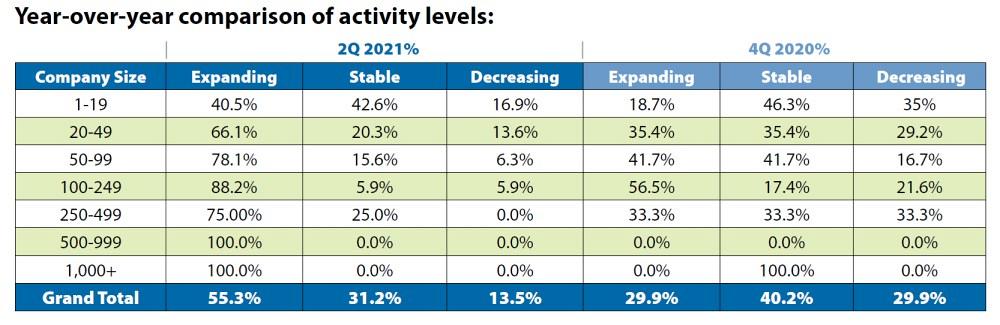

In addition to the capacity issue, nearly half (46.8%) of the report’s respondents said that capacity has increased from Q4 2020 and another 40.8% said capacity usage is stable. That’s encouraging since those numbers are above the national average.

On the capital investment front, a majority of shops reported that capital plans are on track (47.1%), while 10.8% have delayed for a quarter and 14.9% are delaying until the start of 2022.But 27% of respondents say that they are holding off big purchases for the unforeseeable future.

"The differences have a great deal to do with how the recovery has proceeded in each sector," Kuehl said. "Those feeding into sectors still affected by the pandemic are reluctant to make big investments at this stage."

And, of course, there’s the matter of the top two concerns facing nearly every job shop: the labor shortage and material costs.

The FFJSCR report shows that labor continues to be an only slightly improving issue. Of the shops surveyed, 37.2% added to the workforce and 10.1% saw a decline in adding employees. That means 52.6% of shops reported that hiring has been stable. But that data doesn’t tell the whole labor story.

“What is harder to quantify is the number of companies that would hire more if qualified applicants were available,” said Kuehl. “Many are also asserting that it has become harder to hire low-skilled workers these days, as many are still sitting it out until their expanded benefits expire.”

To absolutely no surprise, not a single shop surveyed reported paying lower prices for steel and aluminum in Q2. A whopping 96.2% experienced higher material costs and only 3.7% saw stability. With that comes increases in logistics: 100% said costs were up (89.4%) or stable (10.5%).

“These prices are expected to remain high through the bulk of this year but will likely start to retreat towards the end of 2021 and the start of 2022 as producers catch up and demand begins to wane a bit,” said Kuehl.

But there’s mostly optimism among job shop owners: 56.2% expect a positive outlook for the rest of 2021, 34.6% expect stability, and only 8.4% think the situation will worsen.

“These are the most upbeat reactions to the future seen in quite a while,” Kuehl said.